PLAYING BLACKJACK ABROAD: DIFFERENT RULES, TAX, AND CURRENCY REGULATIONS

This chapter provides information on what to expect when playing blackjack outside the U.S., including declaring your winnings. Additionally, I’ve summarized the relatively new U.S. regulations regarding currency cash transactions that you should be aware of when you play blackjack.

PLAYING ABROAD

Blackjack is blackjack, right? Not necessarily, especially if you plan to play in casinos outside the United States (and in some online casinos). Below are some tips to give you a heads-up on what to expect so you’ll be prepared.

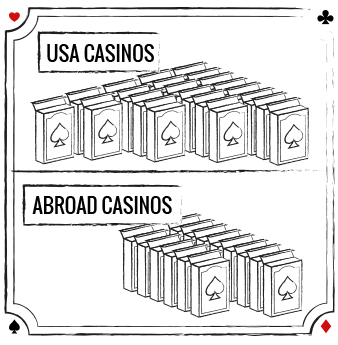

NUMBER OF DECKS

You’ll find mostly six-deck games in U.S. casinos with also some single- and double-deck games. Casinos abroad deal mostly six-deck games with single- and double-deck games rare. In addition, you will often find single-deck games in American casinos that pay only 6-5 for a blackjack and also blackjack variants like Spanish 21, Blackjack Switch, and Free Bet Blackjack. In casinos abroad, you are more likely to find traditional blackjack games that pay 3-2 for an untied blackjack, with no side bets and few blackjack variants (except the popular Pontoon, similar to Spanish 21).

DEALER’S DOWN CARD

In the U.S., the dealer takes her second (down) card before players act on their hands. In casinos abroad, the dealer will not take her second card until after all players have acted on their hand. (This is known as the No-Hole-Card Rule).

IMPACT OF THE EUROPEAN NO-HOLE-CARD RULE (ENHC)

In most European casinos (and online casinos) that have the ENHC rule, when a player doubles down or pair splits and loses to an eventual dealer blackjack, the player loses the initial wager and the secondary wager(s) made by doubling and pair splitting. (By contrast, in virtually all U.S. casinos, the dealer peeks at her down card and if she has blackjack, you don’t get a chance to double or split and you lose only your initial wager.) The ENHC rule increases the house edge by about 0.11 percent and it requires the following changes to the basic playing strategy compared to an American game (assume six decks, dealer hits soft 17, doubling after pair splitting is allowed, and no surrender):

Hit hard 11 vs. dealer 10 (instead of doubling);

Hit Ace-Ace vs. dealer Ace (instead of splitting);

Hit 8-8 vs. dealer 10 and Ace (instead of splitting).

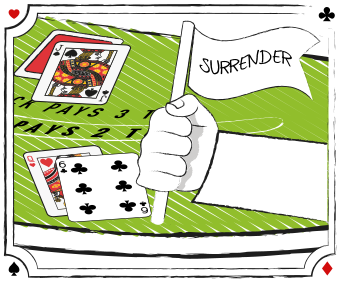

SURRENDER

The common form of surrender in American land-based casinos is known as late surrender where you can surrender your hand and lose half your wager only after the dealer has checked for a blackjack and doesn’t have it. Some casinos in Europe and Asia (and some online casinos) allow early surrender where you can surrender your hand before the dealer checks for a blackjack. Early surrender is a much more favorable rule for players than late surrender. (According to Arnold Snyder, author of The Big Book of Blackjack, in a multi-deck game early surrender gains you:

- 0.63 percent (s17 game), or

- 0.72 percent (h17 game).

If you can early surrender only against a 10 upcard, the gain is 0.24 percent. By comparison, late surrender gains you only 0.07 percent (s17) or 0.09 percent (h17).

The basic playing strategy for early surrender in a multi-deck game (s17) is as follows:

- Against a dealer ace, surrender hard 5 to 7 (including 3-3) and 12 to 17 (including 6-6, 7-7, and 8-8);

- Against a dealer 10, surrender hard 14-16 (including 7-7 and 8-8);

- Against a dealer 9, surrender hard 10-6 and 9-7 (but not 8-8).

Besides lowering the house edge, surrender (late, and more so, early) also has the benefit that it will stabilize your bankroll (meaning surrender will flatten the fluctuations in your bankroll compared to a game where surrender is not offered and you have to play all your hands to completion). This is important not only for basic strategy players but more so for card counters.

INSURANCE

In most American casinos, you are offered the insurance wager (i.e., betting the dealer has a blackjack) only when the dealer shows an ace upcard. (In some casinos, you are also allowed to make the insurance wager against a dealer 10 upcard.) In some casinos abroad (especially in England), you can only make the insurance bet when you have a blackjack (which is the same as taking even money, meaning you will be paid even money if you take it, regardless if the dealer subsequently has a blackjack).

CARD COUNTING

Card counting is less tolerated in American casinos. There are often better games for card counters abroad than in American casinos, and in general, bigger bet spreads are more tolerated.

DECLARING BLACKJACK WINNINGS

It’s exciting to visit an exotic place and win lots of money playing blackjack. However, nothing can be more frustrating when you return home and the U.S. customs agent asks, “Sir, where did you get all that money from?” To save you from that embarrassing situation (and a potentially stressful one if they confiscate your money, which they can and sometimes do), you need to know how to declare your blackjack winnings.

There are rules for declaring your winnings when you enter different countries. Furthermore, in the U.S., there are regulations for when a casino has to report your winnings (i.e., currency cash transactions) to the Internal Revenue Service (IRS). What follows is a strategy you should use to keep you out of trouble with governmental agencies both here and abroad.

(Note: I am not a lawyer; what you are about to read comes from my research of the regulations, interviews with professional players and casino managers, and my own experiences.)

U.S. CUSTOMS

Even though there are no restrictions on the amount of money you can take into or out of the U.S., there are rules if you happen to carry more than $10,000 in currency or “monetary instruments.” You are required to report negotiable monetary instruments (i.e. currency or endorsed checks) valued at $10 ,000 or more on a "Report of International Transportation of Currency or Monetary Instruments." (For more details on this, read the “Currency and Foreign Reporting Act” available on the Internet.)

The reason for the above is because the Customs Department knows from experience that large sums of cash are often carried by criminals, particularly drug traffickers. (Somehow they don’t believe it’s possible for a blackjack player to carry that much cash.)

If you happen to be carrying over $10,000 in cash and you don’t declare it on the above form, bad things can happen which include confiscating the cash. (And getting it back can often take months even with the help of an attorney.)

What about carrying a large amount of cash within the U.S.? If the National Transportation Association (NTA) checkers at the airport security check points spot the cash, you could be turned over to the Drug Enforcement Agency (DEA) for further search and questioning, and they can also confiscate the cash.

If you think the above is scary, try carrying large amounts of cash from one foreign country to another where the regulations for carrying cash are not always the same. One misstep and you might find yourself in a jail somewhere in Timbuktu.

I hope I have your attention on the potential seriousness of carrying a lot of cash; therefore, let me offer you several tips from Vinny DeCarlo, a long-time casino executive. (These tips appeared in articles he wrote in Blackjack Insider e-newsletter and All In magazine.)

1. Try to avoid carrying large sums of cash. If that’s not possible, carry cashier’s checks made out to you.

2. FedEx the money to yourself. (Note: Even though FedEx advises not to ship cash, many professional players do it anyway.)

From home, mail it to a casino; the front desk employees will let you know you have a FedEx envelope. (You might contact them beforehand to alert them to expect the FedEx envelope.)

In addition, have documents with you that prove you are a gambler (professional or recreational). These can include:

- Your gambling log

- Copy of a certified tax return

- Letter from your attorney stating you are a either professional gambler, or you are on a gambling trip and the cash you are carrying is for gambling

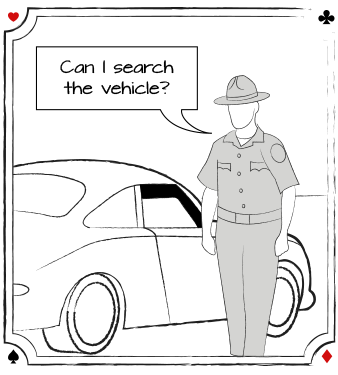

TRAVELING BY CAR IN THE U.S.

Card counters who have large sums of money on them when traveling by car within the U.S. also have to careful. This is because if you happen to be pulled over by a local policeman (or state trooper) for, say, speeding, he might decide to ask to search your vehicle. And if he happens to spot a lot of cash, try explaining that you are a card counter.

Technically, if you are in your own vehicle, the officer is supposed to ask your permission if he or she can search the vehicle. (He doesn’t need your permission if you’re driving a rental car.) Marc Viktor, an attorney from Arizona, was quoted in All In magazine as saying that a card counter should refuse to have his car searched by saying the following:

“I refuse to consent to any search whatsoever of my premises, my person, my immediate location, or my vehicle. I hereby exercise my rights as enumerated by the Fourth, Fifth, Sixth, Ninth, and Fourteenth Amendments to the United States Constitution. I demand to have my attorney present prior to and throughout any or all questioning. Additionally, I wish to consult with my attorney prior to any discussion with law-enforcement officers on the subject of waiver.”

(Note: When I was a very active player, and traveling a lot, I carried the above on an index card, just in case. I would suggest you do the same or consult your attorney on what to say and do if the above scenario happens to you.)

Bottom line: If you are traveling with a lot of cash, it’s wise to take every precaution so that it won’t be seized by a government agency here or abroad. Otherwise, the chance of your getting your money back in a timely manner is, according to some of my colleagues who have experienced this, “slim to none.”

CASH TRANSACTION REGULATIONS

Cash transactions in American casinos are regulated by the U.S. Bank Secrecy Act (also known as Title 31). If you are playing blackjack, you might have to provide a photo ID containing your current address and your social security number. And get this … if you refuse to give this information to the casino, you won’t be able to continue playing, and you will be asked to leave the premises.

The Federal regulation known as the Bank Secrecy Act (BSA) of 1970 was intended to assist U.S. government agencies to detect, deter, and prevent criminal activity known as “money laundering” (i.e., the process whereby the proceeds of crimes are transformed into ostensibly legitimate money or other assets). Originally, the regulation focused on banks and other financial institutions; however, because large sums of money flow into and out of a casino, the casino industry was included in the regulation in 1985.

The BSA requires that all casinos in the U.S. that generate more than a million dollars in annual gaming revenue report certain currency transactions to the Financial Crimes Enforcement Network (FinCEN) in a timely manner. Failure to do so could result in hefty fines for the casino.

Under the BSA, whenever the aggregate cash transactions between a customer and a casino exceed $10,000 in a 24-hour gaming day, the casino must fill out a Currency Transaction Report (CTR) and file it with FinCEN within 15 days. This means anytime a player buys chips at a table, deposits money in the cage, or redeems chips at the cage in a single or multiple transactions that total over $10,000 in a 24-hour period, the casino must file a CTR. The latter includes the player’s name, occupation, and social security number (and the casino must verify the player’s identity via a legal driver’s license, passport, or other form of ID). It is also important to note that the casino does not have to notify the player that it filed a CTR on him or her.

Here’s an example of how this works. Suppose a player purchases $3,000 worth of chips at a blackjack table. Several hours later, the player buys in for another $5,000 at a different blackjack table. After several more hours, he buys in for another $3,000. Each buy-in is with “fresh” (not “recycled”) money. Because the total of his three buy-ins exceeds the $10,000 threshold (in a 24-hour period), the casino is obligated to file a CTR for this currency transaction. Keep this in mind: It doesn’t matter how much you are winning or losing at any time in the casino; the only trigger for the CTR is that the total of your cash transactions ex ceeds $10,000 in a 24-hour period.

In order to stay compliant with the BSA, casinos create tracking programs to identify large cash transactions and automatically aggregate them in real time. Cash transactions as low as $3,000 (and in some casinos even lower) are recorded by casino personnel (sometimes unbeknownst to the player) to ensure that they remain compliant with the CTR requirements.

In addition to the CTR, the casinos are required to file a Suspicious Activity Report (or SAR) for any suspicious transaction that is discovered by casino staff involving at least $3, 000 in funds. For example, if a casino believes a player is trying to avoid a CTR reporting requirement by breaking a cash transaction in excess of $10,000 into multiple smaller transactions (known as “structuring”), the casino is required to file a SAR. In addition, if a player is caught engaging in such activity, he or she could be convicted of “willfully structuring financial transactions” to avoid currency reporting requirements, which is punishable by a fine and up to five years in prison.

According to the regulations, SARs must remain confidential; in fact, it is a crime if a casino even discloses that it filed one, and by law, it is not allowed to tell a player that the report exists.

Casinos and their employees can get into hot water if they don’t follow the requirements applicable to CTR or SAR filings. Therefore, casinos go to great lengths to train their employees in the requirements of these regulations, and put in place systems and procedures to track large cash transactions in real time. For example, casino employees know that it is illegal for them to help a player circumvent any of the CTR regulations. This inclu des advising a player that he or she is reaching the CTR $10 ,000 threshold (so don’t ask a casino employee that question). In addition, if a player exceeds the $10,000 threshold for cash transactions in 24 hours but refuses to provide an unexpired photo ID and/or a social security number, the casino must not allow the player to continue to play (including cashing out any chips the player may have), and must escort the player off the property.

(Note: For the purposes of clocking the 24-hour period in question, not all casinos begin the time period at, say, 12 midnight or 12 noon, so it may be difficult for a player to know exactly what 24-hour period he or she has to be aware of. Furthermore, don’t even think about trying to get information about a casino’s 24-hour gaming day from a casino employee because this law forbids him to disclose it.)

Casinos want to protect players’ privacy; however, they are obligated under this Federal Law to report large and/or suspicious currency transactions. From a player’s perspective, understand that casino employees are only doing their job when they ask you for personal information after you make a single or several large currency transactions. Like it or not, the Bank Secrecy Act is something players and the casinos have to live with.

KEY TAKEAWAYS

- Blackjack playing rules in foreign casinos may be different than in U.S. casinos

- The ENHC Rule increases the house edge if secondary wagers made when doubling and splitting lose to a dealer blackjack

- If you can surrender you hand before the dealer checks for a blackjack, this is known as early surrender, a very player-friendly rule

- When leaving or returning to the U.S. with more than $10,000 in currency or “monetary instruments,” you must declare the amount on a customs form

- If you are a high-stakes player and carry a lot of money, it’s wise to have documents on your possession that prove you are either a professional gambler or a high-stakes casino player

- Casinos track all cash transactions between a player and casino, and if the amount exceeds $10,000 in a 24-hour gaming day, they must file a Currency Transaction Report (CTR) to FinCEN

- Casinos are also required to file a Suspicious Activity Report (SAR) for any suspicious transaction that is discovered by casino staff involving at least $3,000 in funds

- If a player is suspected of “structuring” to avoid a CTR, he or she could be fined and receive up to five years in prison

- Casinos can be fined if they don’t follow the requirements applicable to CTR and SAR filings.

TEST YOURSELF

QUESTIONS:

- Casinos abroad use mostly how many decks of cards?

- What do most dealers do in casinos abroad compared to U.S. casinos?

- What are the changes to the basic playing strategy with the ENCR rule and player’s losing secondary wagers on doubles and splits?

- What is early surrender and how does it compare with late surrender?

- Besides lowering the house edge, what else does early surrender do?

- If you happen to carry more than $10,000 in cash out of or into the U.S., what must you do at the airport?

- What are the types of documents you should carry with you to prove that the reason you are carrying a lot of cash is because you are gambling?

- You purchase $2,000 at a blackjack table and you lose it. You immediately switch tables, buy in for $3,000 and win $2000. You take an hour break and then buy in for $6,000 and lose back $2000. Are the casinos required to file a CTR?

- What is a SAR?

- What happens to a player if he is suspected of “structuring” to avoid a CTR?

ANSWERS:

- Mostly six and eight decks; rarely single and double decks.

- They don’t take their hole card until after players act on their hand. (Known as No-Hole-Card Rule.)

- For a six-deck game with h17, das, and no surrender, you should hit hard 11 vs. dealer 10 (instead of doubling); hit Ace-Ace vs. dealer Ace (instead of splitting); and hit 8-8 vs. dealer Ace (instead of splitting).

- With early surrender, a player can surrender his hand before the dealer checks for a blackjack. This is a much more favorable rule for players compared to late surrender, where a player can surrender his hand only after the dealer has checked for a blackjack and doesn’t have it.

- It stabilizes your bankroll, meaning it flattens the fluctuations.

- Declare the amount on your Custom’s Declaration Form.

- Your gambling log, certified tax return, and letter from your attorney.

- The amount you won and lost has no bearing on whether the casino must file a CTR. In this example, your cash transactions exceeded $10,000 in a 24-hour gaming day ($2,000 + $3,000 + $6,000 = $11,000) and so the casino must file a CTR.

- SAR is a Suspicious Activities Report. Casinos must file a SAR for any suspicious transactions that are discovered by casino staff involving at least $3,000 in funds.

- The player could be fined and sent to prison.